As we dive into the dynamic world of cryptocurrency mining in 2023, the concept of mining machine hosting emerges as a beacon of opportunity, blending cutting-edge technology with savvy investment strategies. Imagine vast arrays of powerful machines humming away in optimized facilities, churning out digital gold without you lifting a finger. This service, offered by companies specializing in selling and hosting mining equipment, allows individuals and businesses to tap into the lucrative realms of Bitcoin, Ethereum, and even the whimsical Dogecoin, all while sidestepping the hassles of setup and maintenance. With market fluctuations and technological advancements shaping the landscape, profit predictions for 2023 paint a picture of both excitement and caution, urging enthusiasts to arm themselves with knowledge before plunging in.

The essence of mining machine hosting lies in its ability to democratize access to high-powered computing resources essential for cryptocurrency extraction. For Bitcoin aficionados, this means leveraging advanced ASIC miners that solve complex cryptographic puzzles to validate transactions and earn rewards. These machines, often sold by specialized firms, are then hosted in secure data centers where electricity costs and cooling systems are managed professionally, potentially boosting efficiency and profitability. Meanwhile, Ethereum’s shift towards proof-of-stake in 2023 could alter the game, making hosting services even more appealing for those eyeing energy-efficient alternatives to traditional mining rigs. And let’s not forget Dogecoin, that meme-born phenomenon; its community-driven surge might inspire a new wave of miners to host rigs dedicated to this fun-loving currency, turning what was once a joke into a serious profit avenue.

Turning our gaze to Bitcoin specifically, 2023 profit predictions hinge on several volatile factors, including hash rate competitions and global regulatory shifts.

As the flagship cryptocurrency, BTC’s value could soar or plummet based on market sentiment, with hosting services offering a buffer against personal operational costs. Experts forecast that with electricity prices stabilizing and network difficulty adjusting, hosted miners might see returns ranging from modest gains to exponential windfalls, especially if BTC breaches new all-time highs. This unpredictability adds a thrilling layer to the investment, where one day you’re riding the wave of a bull run, and the next, navigating choppy waters of a bear market.

Shifting gears to Ethereum and Dogecoin, the profit landscape becomes a tapestry of innovation and community fervor. Ethereum’s much-anticipated transition to Ethereum 2.0 promises to reduce the environmental footprint of mining, potentially making hosted ETH operations more sustainable and attractive to eco-conscious investors. Picture rows of energy-efficient miners in vast hosting farms, silently contributing to the blockchain’s integrity while yielding steady rewards. Dogecoin, on the other hand, thrives on its viral appeal; hosting a rig for DOG could capitalize on sudden price pumps driven by social media buzz, offering quick, albeit risky, profits that keep the adrenaline pumping. These currencies, alongside others like Litecoin, underscore the diversity of the crypto ecosystem, where hosting services act as the great equalizer.

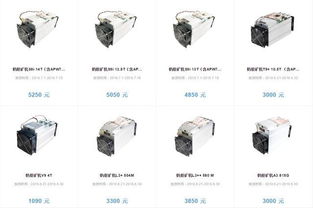

At the heart of this ecosystem are the mining machines themselves—robust devices that range from compact miners to elaborate mining rigs, all pivotal to the hosting model. A typical miner, such as an Antminer or Whatsminer model sold by leading companies, is engineered for maximum hash power, ensuring it can compete in the cutthroat world of blockchain validation. When hosted, these units benefit from professional oversight, minimizing downtime and maximizing uptime, which directly translates to higher yields. Yet, the magic doesn’t stop there; integrating multiple miners into a cohesive mining rig setup amplifies efficiency, turning individual components into a symphony of computational prowess that could redefine your profit margins in 2023.

Delving deeper, mining farms represent the industrial backbone of this operation, vast warehouses filled with thousands of machines working in unison.

These facilities, often located in regions with cheap electricity and cool climates, host an array of equipment dedicated to BTC, ETH, and beyond, creating economies of scale that individual users can’t match. For instance, a farm optimized for Dogecoin might run lighter rigs to handle its less demanding algorithm, allowing for diversified portfolios that hedge against market risks. The burst of activity in these farms, with lights blinking and fans whirring, embodies the relentless pursuit of digital wealth, where every second counts toward potential profits.

Of course, no discussion of 2023 profits would be complete without addressing the myriad factors that could sway outcomes. Electricity costs, a perennial thorn, might fluctuate due to geopolitical tensions, directly impacting the viability of hosted mining for energy-intensive currencies like Bitcoin. Exchange rates and trading fees on platforms like Binance or Coinbase add another layer of complexity, as miners must navigate the best ways to liquidate their rewards. Moreover, the rise of quantum computing poses a futuristic threat, potentially rendering current mining rigs obsolete, while regulatory crackdowns in certain countries could dampen enthusiasm. Yet, amidst these challenges, the allure persists, driven by a community that’s as passionate as it is resilient.

In wrapping up, the profit predictions for mining machine hosting in 2023 offer a compelling narrative of opportunity laced with uncertainty. Whether you’re drawn to the stability of Bitcoin, the innovation of Ethereum, or the community spirit of Dogecoin, hosting services provide a strategic edge in this ever-evolving arena. By understanding the intricacies of miners, rigs, and farms, investors can make informed decisions that balance risk and reward. So, as you contemplate your next move in the crypto world, remember: knowledge is your most valuable asset, turning potential pitfalls into pathways of prosperity.

One response to “2023 Profit Predictions for Mining Machine Hosting: What You Need to Know”

-

A crystal ball for miners? This article digs into 2023 hosting profits. Forget static ROI, expect volatility fueled by energy costs and crypto winter winds! Essential reading before plugging in.

Leave a Reply